Up to Standards

- Subject: Adding value to compete successfully in difficult times

- Essential Reading: Shop Owner, Center Manager

- Author: Mike Weinberg, Rockland Standard Gear, Contributing Editor

Trends are created every day, and like living things they take on a life of their own. They grow, they change and modify, they mature, and they change all aspects of your life.

There are lifestyle trends that have a huge effect on society. These include the Internet, which has changed life on the planet in a big way. Today there are more information, business opportunities and research available through the computer on a worldwide basis than ever before.

As the Internet has matured it has changed through advances in technology that created cell phones, which have now become mobile personal computers, and created new means of communicating through things like Facebook and Twitter, where people are laying their whole lives out for the world to view. People now make calls to 40 people a day, every day. Personally, I don’t know that many people whom I need to speak with on a regular basis, but this is our present trend.

Trends in our business have changed dramatically so that customers can price-shop or buy parts or reman units on the Internet and then seek someone to install them. This puts a lot of pressure on price as the most-important factor in the business equation, with quality becoming a less-important factor in the decision. It is very easy to get caught up in this squeeze between what cheap is and what good is. There is a difference between spending less money on repairs and buying a better-quality job. That difference is “value added,” and it is vital that you know and understand the difference and explain that to your customers, and that you practice the same policies in your business purchasing.

Example: You can repair a transmission by replacing the worn or broken parts and the unit will function again, without any updates or cures for the design defects that caused the original failure. The alternative is to update the unit with improved parts and redesigned components so that the customer gets greater value for his purchase and you have a lower rate of comebacks or returns. The cost of a comeback is totally on the shop that issued the repair and the warranty, plus you have to factor in “lost-opportunity costs” (LOC).

LOC occurs when you have people and lifts tied up fixing a comeback for which you absorb 100% of the cost, while not being able to use the same people and equipment to do a job that would generate a profit. Therefore, you need to resist the offer of a lower-priced part for one of superior quality and durability, backed up by a supplier that can help you with problems during the overhaul. We have an oversupply of people selling transmission parts, and to compete they sell at low prices with no “value added” to you. We have phone calls every week from rebuilders who bought parts solely on the basis of price and have issues during the rebuild with which the low-price volume supplier can’t help them. When these calls come in they ask for help, and we ask, “Where did you buy the parts, and why didn’t you purchase from us”?

The answer is, “We saved a few dollars with XYZ company.”

The fact is they didn’t save anything, because they can’t get the help from the vendor to get the job out the door and they have lost time and money right away. The few dollars they perceived as a saving actually wound up much more costly than dealing with a vendor qualified to give them the value-added help they need for a few bucks more. No one buys parts to put them on the mantle at home. Parts are for resale and are a profit center for the shop. Any purchase made that does not come with expert knowledge from the supplier will be a more-expensive purchase in the end.

Another trend that is causing industrywide issues is parts proliferation. The never-ending increase in the models of transmissions to be worked on makes stocking the proper inventory levels very difficult for the average shop. The supplier becomes the warehouse and tries to give the shop just-in-time delivery of the parts they need for a job on the bench. This means that the supplier has to forecast demand in advance of sales so that it can have proper levels of inventory, as the manufacturers of the parts have lead times, which can be anywhere between three and six months from order to delivery. This means that every supplier has increased its inventory levels to match demand and lead time to order, with a resulting increase in carrying costs of the inventory.

A secondary issue to the parts-supply problem is “captive” parts. Captive parts are those that are manufactured by suppliers for the auto manufacturers. For instance, BorgWarner, Magna Powertrain, Tremec Transmissions, ZF, American Axle, Dana etc. produce transmissions, transfer cases and differentials for the carmakers. The carmakers insert language into their contracts that any parts made with tooling they have bought cannot be sold into the aftermarket and you can buy them only through the dealer network.

Car dealers, like other business owners, want to stock only high-volume, fast-moving parts, which creates a delay in getting these low-volume parts and makes it harder to get the customer back on the road. Parts are also more expensive from the dealer than from the aftermarket. This policy is designed to keep the sales within the dealer network but is shortsighted. In the end, if the car owner cannot get his car repaired quickly and reasonably the brand name takes the hit and he will not buy another car from that company. The second outcome from captive parts is that if there is a reasonable volume, the aftermarket will tool up to produce the parts at prices lower than the dealer’s.

Another disturbing trend is the lack of good technical information to the aftermarket from the manufacturer. I am not one to see collusion and conspiracy around every corner, but it has become quite difficult to find information from the manufacturers even though federal law requires it. There are many trade associations that are fighting that battle on a daily basis, and it is in your interest to support them to protect your investment and livelihood.

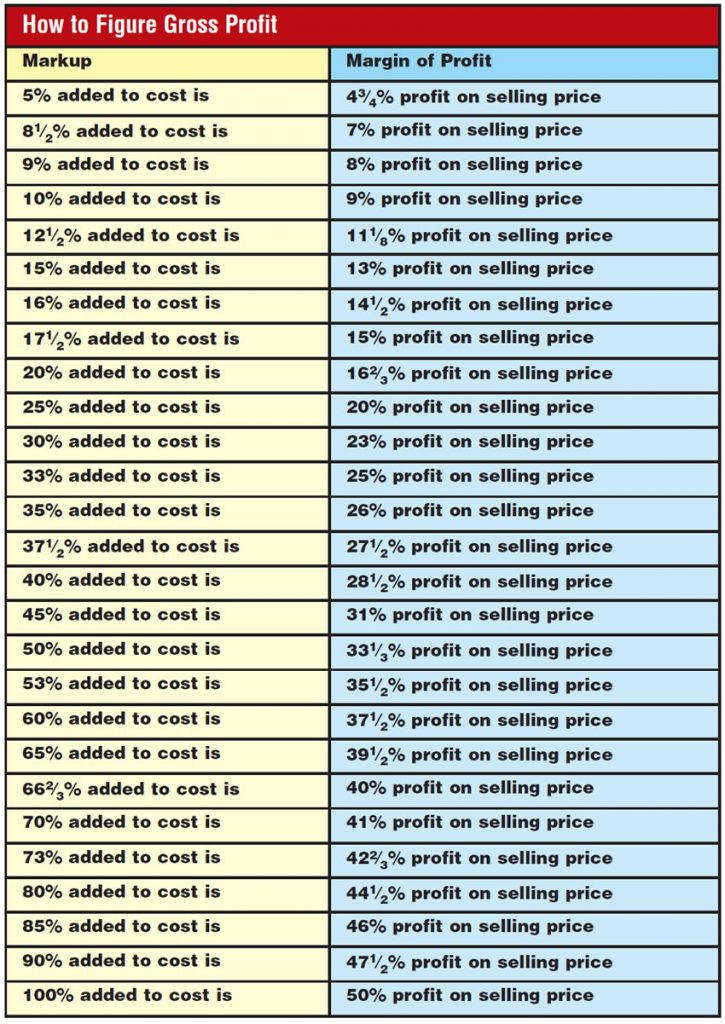

We spoke earlier of value added and price-vs.-quality issues. It is very important for you to understand how to price your work and parts sales. Very few business owners understand the difference between margin and markup. Markup is the percentage added to the purchase price to assure a profit. Margin is the amount of profit gained from a specific markup. THEY ARE NOT THE SAME.

Example: You buy a part from the dealer at a 25% discount from the dealer list price. If you bill the customer at list price, you are NOT making a 25% parts profit; you are actually making 20%. Markup to margin must be figured using a scale, which I have included with this article. Looking at the scale you will see that if you mark up an item by 100% you will achieve only a 50% margin.

The first issue is, what margin do you need to make to be profitable? The second issue is to realize that the dealer list price is only a suggestion. The dealer lists it as MSRP: manufacturer’s suggested retail price. This should mean zero to you. Does the manufacturer pay your overhead? The dealer makes a suggestion that, if you are foolish enough to take it, gives you a profit margin between 9% and 20% on average. You can never be profitable at these levels unless you are selling massive amounts of parts.

Now comes the question, “How can I sell over list price”? The answer is value added. What do you do when you order the needed parts for the customer? You make the phone call, you probably have to go to the dealer and pick out the parts, you have the parts delivered and you lay out the money for them, making sure they are correct for the application. What is that worth to the customer? He would have to take time out from his work to do all those things, and he doesn’t have your professional knowledge to make sure it is right. It will be almost impossible for you to mark up parts by less than 40%, which gives you a 28.5% profit margin. Obviously, it will be much easier to make better margins on parts bought through your aftermarket suppliers.

Think “value added” in your purchasing and in your sales technique. Get your markup in line with the correct profit margin you need for your overhead to ensure the correct level of profit on every job. Not considering these as critical factors will decrease your survival chances in a hurry. You need to make enough money on every job to pay your fixed costs and to create a level of profit that gives you and your employees a decent lifestyle to make all the effort and risk worthwhile.