The Transmission Digest Annual Survey of Retail Shops has served as benchmark and planning tool for the industry now for the past 37 years. Charts and tables in this study are based on a survey that was conducted early this year.

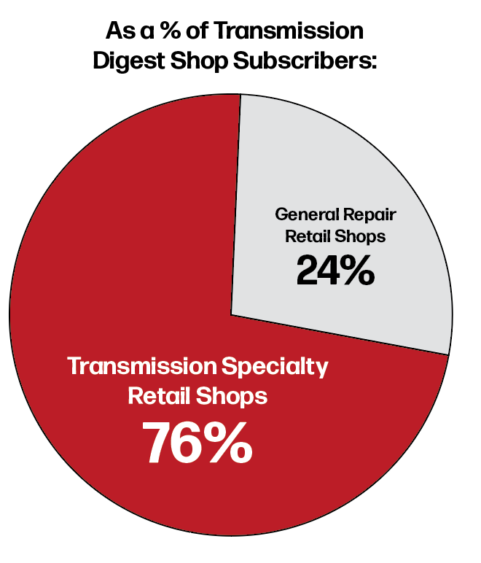

Where differences are obvious, we separate the responses of transmission specialty shops from general repair shops that perform powertrain work in an attempt to create a more accurate picture of the information.

Conversely, when we depict more general information concerning the industry as represented by readership of the magazine, we combine the segments of transmission specialty and general repair shops. In most cases, the information is the result of calculating an arithmetic (or weighted arithmetic) mean of the answers we received.

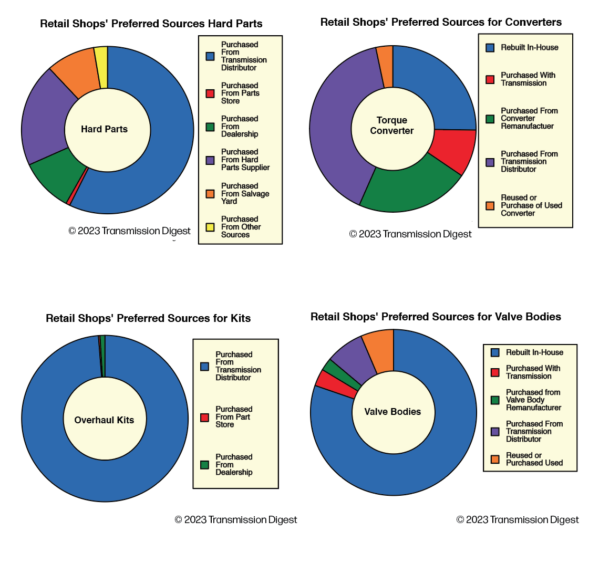

Who’s Selling Us Parts/Sub-assemblies?

One way of examining the shops that make up Transmission Digest’s readership is the survey question, “do you consider your shop to be a transmission specialty shop of a general repair shop?” In the past, there were marked differences between specialty and general repair shops as the former made use of a specialized channel of parts suppliers and distributors while the later relied more often on traditional automotive parts stores, new car dealerships and jobbers.

Differences have become much less apparent as transmission shops became general repair facilities while keeping their preference for obtaining parts and sub-assemblies from specialty distributors and parts suppliers. These days, those same specialty suppliers are available to the general repair shop that rebuilds transmissions.

To indicate faithfully the overall industry’s preference of supply sources, these figures were weighted based on the shop’s reported volume of transmission jobs.

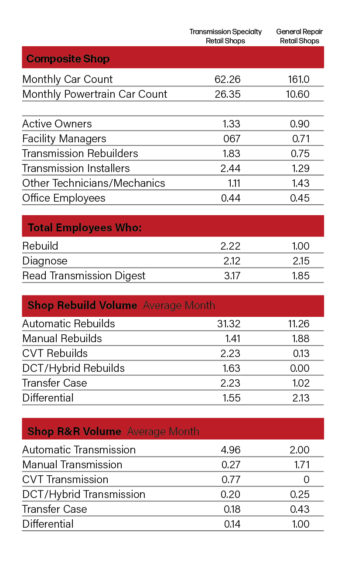

Annual Survey of Retail Shops: Composite Analysis of Transmission Digest Reader Shops

One way of looking at the survey information is to create a composite shop, one that represents the mean average of all the information gathered for certain categories. In creating this composite, we look at self-described transmission specialty shops and general repair shops that perform transmission and related work.

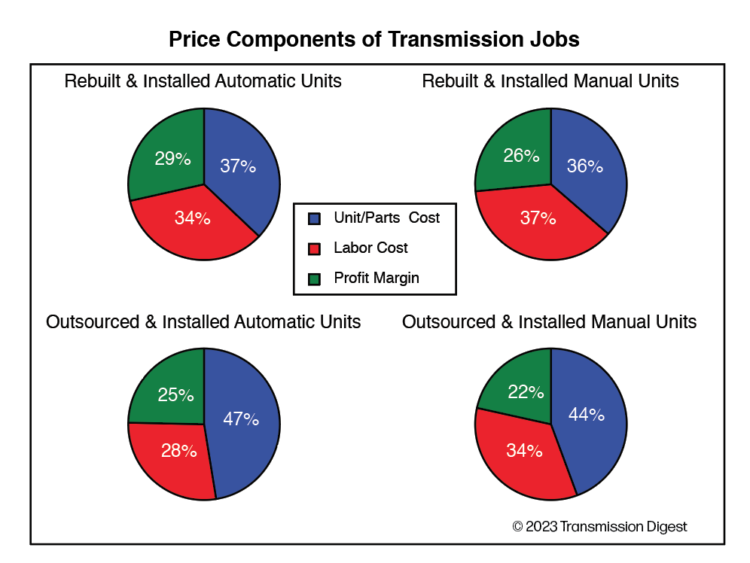

Labor + Parts + Profit = Price

This analysis is important knowledge for any business. It’s worth noting that many retail shops strategize without considering the cost of materials and labor in an effort to match the predominant local price for a particular rebuilt or R&R installed unit. This traditional approach of matching another facility’s price often results in adjusting the job’s profit component in order to reach the price point. Looking at all three of these components gives that shop a chance to explore for cost constraints in an effort to achieve profitability relating to a particular group of jobs.

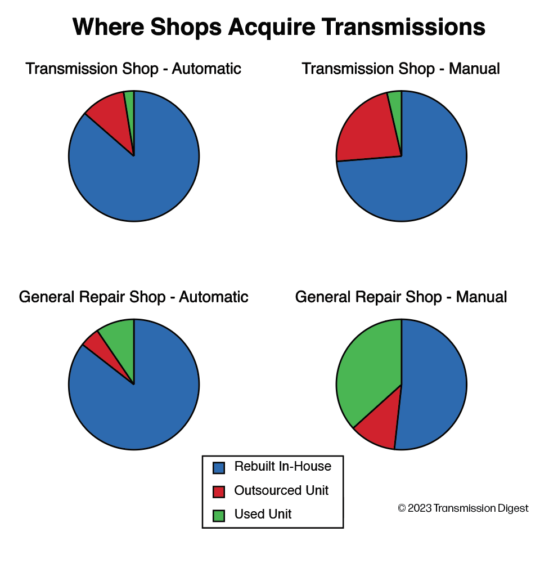

Sourcing transmission units

The survey identifies the percentage of units that shops installed used, those they rebuilt in-house and those that were outsourced. Outsourcing includes transmission units that are purchased from bench builders, automobile dealerships, aftermarket production rebuilders and parts distributors.

The charts here assume that the decision of a supplier for outsourced units is based on price, warranty and perceived quality. Therefore we have combined all of the outsourced units into a single category for the graphic depictions.

We have added a weighting factor based on each shop’s report of monthly transmission job volume to accurately portray the overall retail market’s use of the various source categories.

Finally, the pie charts depict the proportion of various unit sources used by those shops that offer the particular service represented by the individual pies.

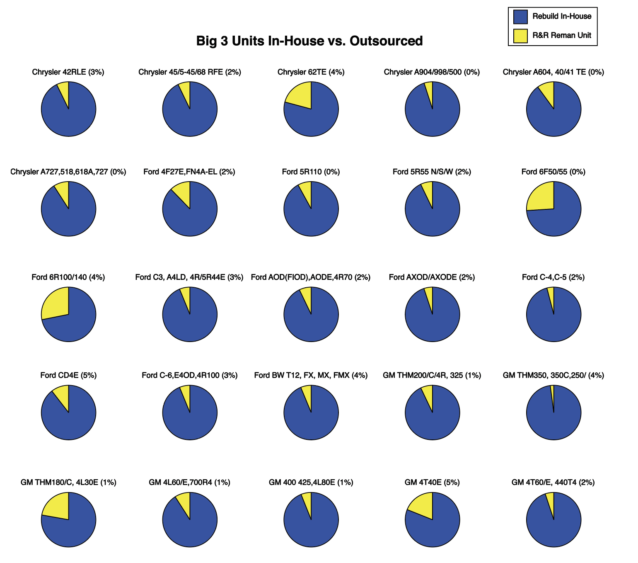

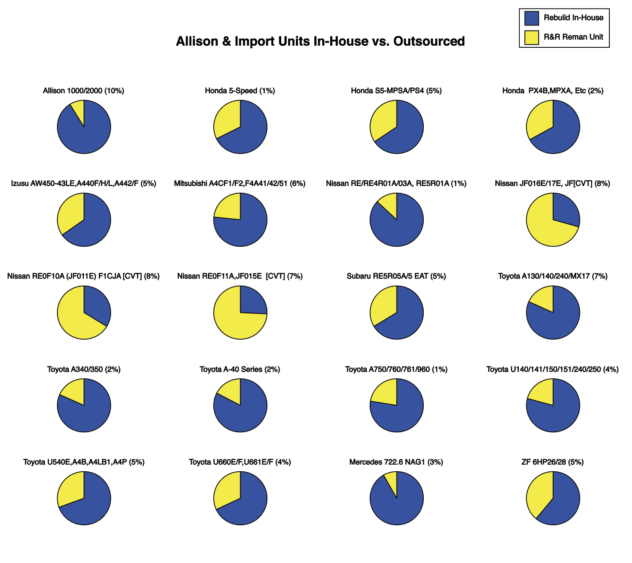

Rebuild it, perform an R&R or refer the job away?

In this series of charts we report on transmission work that Transmission Digest subscriber shops perform. For each transmission family depicted, the shop was asked if that unit was typically rebuilt in-house, replaced with an outsourced reman unit or if the job was referred to another shop.

We weighted the responses by the average monthly transmission jobs reported by each shop; i.e., a shop that works 100 transmission jobs a month is counted more heavily than the shop that handles one a week.

Because referrals end up in another shop represented in the survey, the pie charts show only the ratio of in-house rebuilt vs. outsourced reman units. The figures for percentage of referred jobs are in parenthesis next to the unit name. Historically, the rate of referral varies quite a bit from one year to the next based on the shop habits of responding subscribers.

Finally, the studied families of transmissions are based on kit sales. This year’s survey finds that 50 units/families make up roughly 96% of kit sales.

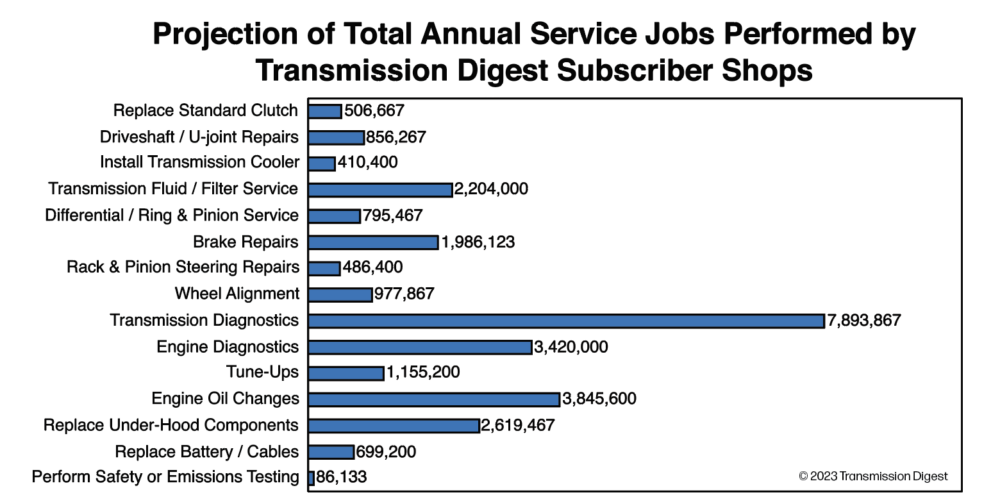

A look at what’s in the bays

There aren’t many measurements that impress the Transmission Digest publishers more than a look at the total number of automotive jobs performed by our readership. Nowhere is the responsibility to maintain a widely varied and cutting-edge content emphasized more strongly to us.

The projected numbers of annual jobs were calculated by taking the average number of jobs for each category as reported by shops responding to the survey, multiplying by the number of retail shop recipients of the magazine and then multiplying by 12 to convert the monthly figure gathered in the survey question into annual projected jobs.

The industry’s most serviced

For the survey we updated the list of most often seen transmissions and/or transmission families. There are 50 of these (based on distributor kit sales). This is an imperfect indicator as the reman factories often use kits specifically formulated for their operations as opposed to the distributor kits used for on-site rebuilding.

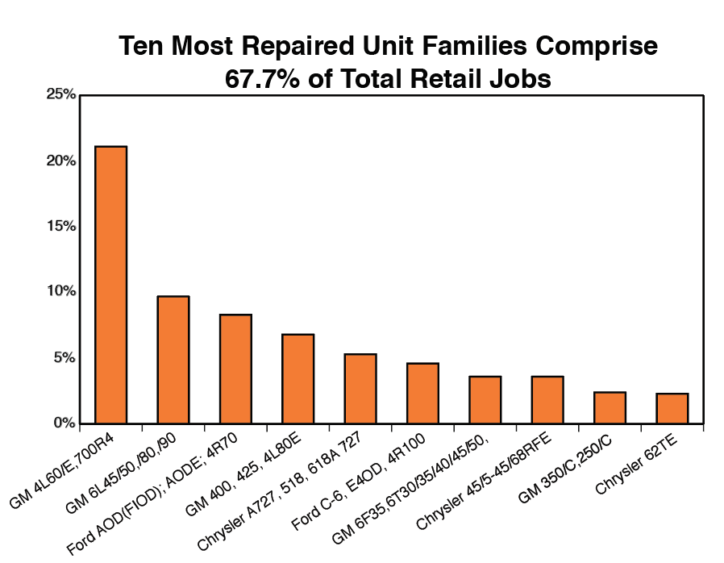

We approximate that these units make up just about 96% of the transmission jobs coming to the aftermarket. The 10 most often seen units accounted 67.7% of all the work showing up in retail bays while the next 40 most popular units combined to add 28.5% of the total jobs.

There are more than 100 additional units that shops commonly repair as well.

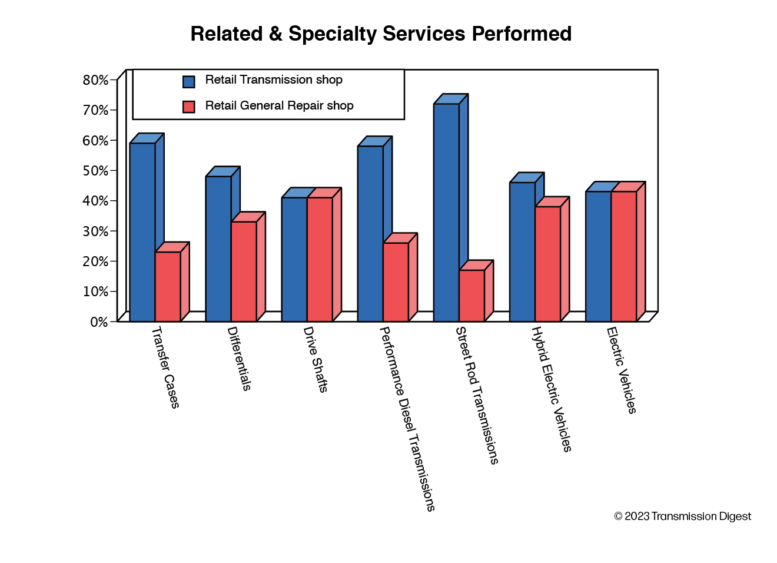

Related specialty services

As part of the questions for this year’s retail shop survey we drilled down beyond the stock transmission rebuilding/repair to see what specific units might also be found in the bays. We’ve written quite a bit about both diesel and gasoline performance work. Up and coming is the work performed on electric and hybrid-electric vehicles.