Whatever It Takes Transmission Parts (WIT)

Whatever It Takes Transmission Parts (WIT) is supplying a growing transmission shop demand for remanufactured units.

As one of the powertrain aftermarket segment’s two nationwide specialty parts distributors Whatever It Takes (WIT) says their growth continues at a rapid, yet still controlled, rate. Opening distribution most recently in Austin and Salt Lake City, the employee-owned company’s founder, Kenny Hester, says that WIT’s growth continues, as does an evolution as it provides product lines reflecting the changing needs of its shop customers.

Recognizing the company’s success is a function of efficiently keeping and quickly delivering all the parts and units necessary to support shop customers, WIT has built a 36,000 square-foot addition in Louisville. “What we’re doing,” Hester explains, “is increasing our capacity significantly by designing the addition to work very efficiently using high bays, narrow aisles and wire-guided pickers. This allows us to inventory most of our product in the addition, which will, in turn, open up more of the original facility so that we can expand the space we use to remanufacture both hard parts and transmission units. We find both of those areas to be growing segments of our total business.

“As inventory has grown we had gotten very spread out with the storage. Putting the high-bay facility close to the carousels that we use to process outgoing orders is going to mean a lot less walking, a lot fewer steps for the people who are filling the orders.

“The floor plan for our operations was great in the beginning, but as we grew it had become a liability. The industry has changed, and there’s been all kinds of consolidations and what have you that have meant there are different requirements for our structure, both space-wise and functionally, than what we had back then.”

Hester also points out that square footage isn’t really the measure of storage capability. Going vertical with narrow aisles can more than double the inventory-holding capability of a facility like this most recent WIT addition.

“Adding space addresses the changing needs of the customer base, Hester says. “The remarkable thing about the industry as we’ve known it is the change that we see in our shop customers who don’t rebuild every unit as they did before. There’s more of a demand from those same shops for reman units. And too, the differences are blurring and I think that we see the future shops in this industry being less specialized by offering their customers more of a general repair and maintenance program that continues to be proficient at handling powertrain and transmission issues.”

Rodney Peters, sales vice president, adds, “It’s going to make us more efficient and to streamline several things we do all aimed at getting parts out the door more quickly and into all 32 WIT distribution centers throughout the U.S. Most important for our customers is that we’ll be able to bring in the right mix of inventory in economical quantities. Customers don’t necessarily care about the buildings, but they do care about what we as a company can do for them. When we get better at doing what we do, they have an easier time of it.

“We’re seeing a serious increase in the demand for the units that we rebuild. We traditionally concentrated on selling the parts they need, but those same shops today want a source of reliable reman units too. We have rebuilding facilities in both Louisville and Denver and we still are challenged to get enough units to fill customer orders. And you know, those are units going to our long-time shop customers rather than units sold around those customers. Our output has gone up to several hundred units a month between those two facilities and still, the demand grows.”

Hester continues, “To my surprise, our manual transmission unit sales are holding up nicely. Having said that, I look at many of the manual specialists having receded or gone away leaving us to pick up that business. So, even while there are fewer manual units out there, the fact that there are fewer suppliers works to our benefit. Those two market forces are offsetting so that the manual transmission business we have is remaining strong.

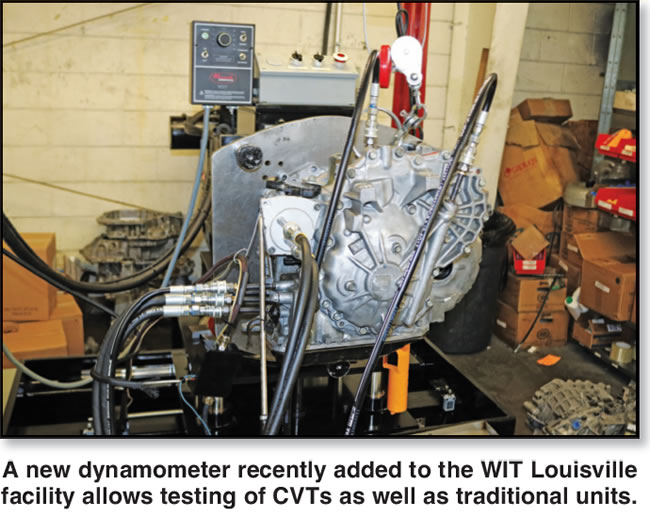

“And the CVT is becoming an area of concentration for us as well. To facilitate that, we’ve purchased a new Dyno that supports testing a lot more of the CVT units that we build here. Additionally, we’re sponsoring a series of rebuilding seminars for our customers that want to build those units for themselves. We believe that learning the ins and outs of these CVT units is good for their business futures.

“I think the whole industry shared the experience of trying to rebuild the Saturn CVT and we all ended up getting our teeth kicked in on those. One major remanufacturer that I had always thought could do anything told me they couldn’t keep those rebuilds on the road. Now, as time has gone on, we have some technical support from Robert [Bateman] and the guys at SAP, and we’ve discovered that with the right approach and knowledge, those units are, in fact, fixable.

We’ve been putting on those seminars at the clip of more than one a month for more than a year now. There’s a video of that information that we’ve put up on our website, and I believe it was featured in the Transmission Digest ePowertrain Bulletin video section too.”

Peters explains, saying, “The CVT training is a way we can give something back to our customers that they don’t have to pay for. They are very appreciative of that too. We put on the workshops, we feed them, we provide them with work manuals, and we have the parts with us so they can see how everything goes together. I think over the past two years the workshops have served more than 2,000 builders. It’s been a great success!”

Looking to continue expanding, Peters says, “I hope we’ll be able to get a few additional locations up and running before this year is up. There are areas of the country that still are dissatisfied that they aren’t able to get parts orders delivered quickly enough to satisfy their needs and the needs of their customers. And, as the consolidation of distribution continues, there are areas that had been used to getting three-times-a-day delivery that now are maybe getting night-box delivery but only a couple of times a week. They’re re-evaluating distributors and we want to be there to fill those niches.

“We’ve always have had the night-box routes for outlying areas we serve but we’re delivering in metropolitan areas where we have a strong business as often as four or, in a few cases, five times daily. We’re structuring everything we do to get these guys the parts they need to get the car out the door and make a little money for themselves. Every success we have is based on the service we can and do provide.

“The strongest thing we have going is the same thing we’ve always done, and that’s emphasize the relationships that are ongoing between our reps and those customers. We take care of them. We could always be the cheapest, we can always try to deliver the fastest, but the thing that makes the difference is that we have to give that service.

“A lot of our success comes from the customer loyalty that’s built when we react to their problems, how quickly we issue a warranty credit or replace a delivered part that wasn’t what the customer needed. Those things are priorities for us, that’s just the way we do business and that can’t ever change because that’s what makes us different among our competitors.

“And I’ll tell you something. We can do everything perfect, the right parts with rapid delivery and great support, but if it weren’t for these guys busting it every day to get their customers’ cars back on the road, we wouldn’t be here. We never forget to respect what it is that customers do for us!”

“I think we’re in a great position to continue our growth and to move forward, says Hester. “We will likely continue to find opportunities for us to serve customers, particularly in the western part of the country. I’ve always believed in the employee ownership model that we have maintained while much of the automotive aftermarket in general and the transmission aftermarket in particular have been acquired in consolidations – that means ownership by capital investment groups.

“Our view of those types of ownership structures has led to more short-term focuses and the idea of creating profits with the eye toward flipping the business. With the employees as owners, our folks have taken a longer-range view of developing both products and relationships that parallel the changes and innovations of the industry.”

Hester, Peters and other managers at WIT find they are simultaneously addressing issues of locations, warehouse space, product-line balancing, customer education and any number of the other elements that go into being successful as a specialty transmission parts and units distributor. Summarizing, Peters observes, “We love competing. Part of what makes the industry better for customers is the competition between suppliers. We thrive on the competition that gives the shops options and serves to keep prices under control. At the end of the day, our desire to compete and to be competitive and to be the best is a win for our customers.”