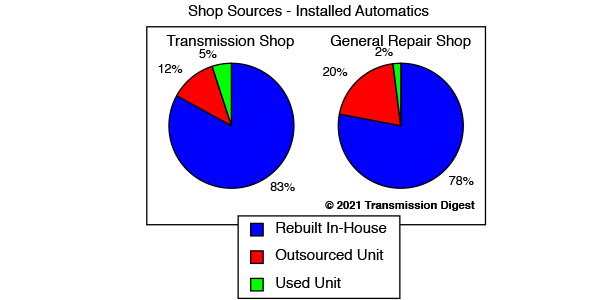

In the 2020s, it is rare that a transmission shop doesn’t enjoy at least some business installing remanufactured transmissions and exchanging the core for the one removed. “Reman” has been around since the early days of automatic units, but the use of remans has exploded in the past 20 years. Legacy Reman operations began to either facilitate volume for multi-location shop chains or supply less specialized, general repair facilities.

Around 30 years ago, Transmission Digest reported that the team at GM had found more than half of the transmission rebuild jobs (warranty and others) from its dealerships were going out the door to independent shops. Similar numbers resulted in major OEMs contracting transmission operations to third-party volume rebuilders, an arrangement that continues to this day.

In recent years, specialized, large-scale aftermarket Reman factories have grown significantly as well. These operations include Jasper, ETE, Certified and Moveras that supply units via multiple channels to shops, fleets and automotive distributors.

Finally, in the mix, nationwide transmission specialty distributors like Transtar and WIT supply their customers’ demands from some combination of wholly-owned Reman facilities and contract arrangements with remanufacturers.

We spent a few minutes speaking with WIT President Rodney Peters to discuss the role of Reman in the traditional transmission specialty retail shop. Peters has a high-level view of both the parts for rebuild and units for the R&R business. Adding to its specialty parts business, WIT has transmission Reman facilities in Kentucky, Illinois and Tennessee.

According to Peters, Reman units make up perhaps 10% of the company’s sales. Still, he observes that business is growing in general and has increased significantly over the past year. He explained that the rate of Reman growth is being accelerated by the same labor shortage seen in many industries. It’s the result of builders who went home during COVID and have not returned to the benches for one reason or another.

“I think a couple of things happened, your older builders are retiring, new ones are not coming in, and the demand for the transmissions is still there,” Peters said.

“And there are some like the 6L80s and 6L90s that are really beginning to blow off the chart, and they can’t get enough of them built. So, I think it’s a mixture of not having the workforce and shortages of the SKUs that are needed. It’s really good for us. It’s good for the entire industry. I mean, everybody I’ve talked to is running behind where Remans are concerned. That’s good business for us and everybody else.

“It’s funny the way the times have changed. And I tell you, I think it’s going to go back and will remind us of how good business was back in the ’80s and ’90s. I think we’re going to see a lot of that in the next five to 10 years because of the turning of the economy.”

Peters sees good business for shops. “I think that the reason the demand has gone crazy is that what’s on the road has been for 12 years,” Peters said. “I think people are not buying new cars right now is that they can’t get them because the OEs can’t get the chips to build them.”

He concludes with the optimistic thought that demand for rebuilding parts and assembled Reman units should see greater demand for the next few years.