We woke up one Tuesday morning realizing that the morning represented the first workday with the 2018-year suffix. All of those well-meant resolutions must either become reality or we must rationalize that we won’t actually achieve them.

The arrival of a new year brings with it an ownership and management need to evaluate how well a shop has been performing and to determine via forward-gazing what would make the shop more efficient and/or effective in providing services at a profit. In years past Transmission Digest has chronicled the changing focus of transmission shops that, in a post-350 world exchanged a specialization in domestic automatics and manuals to one more focused on automatics only, albeit automatics wearing both domestic and international name plates.

As the life expectancy of transmissions, transfer cases and other vehicle systems increased, most shops found new opportunities by using existing bays to provide an expanding menu of general repair services. These opportunities existed as traditional outlets shifted from lifts to lotteries strategizing that pumping gas and running a convenience store is more profitable than pumping gas and keeping technicians busy servicing automobiles.

And now, it’s the year 2018 and every business is still faced with questions of how best to survive and prosper in a competitive retail environment that seems to change its needs every few years. Looking around the shop of most Transmission Digest subscribers, one finds well-equipped service bays with lifts and diagnostic tools and people resources ready to perform a myriad of services. One school of forward-looking strategy would entail bringing more business to the shop by increasing the car count.

From the retail prospective, attracting more cars to the shop is a case of the legendary double-edged sword. One must either take advantage of customer dissatisfaction with the services provided by competing shops or attempt to lure business in by offering competitive services at lower prices. The latter approach can often be short-run effective at attracting price-conscious motorists, but building long-term on such customers runs into the fact that they can easily be lured away by a competitor’s shop that’s a dime to two cheaper than your shop.

The wholesale option

While it takes a little more work and some additional skills related to people and selling, one way of increasing the car count applicable to the current investment in service bays, personnel and equipment is to expand wholesale business opportunities.

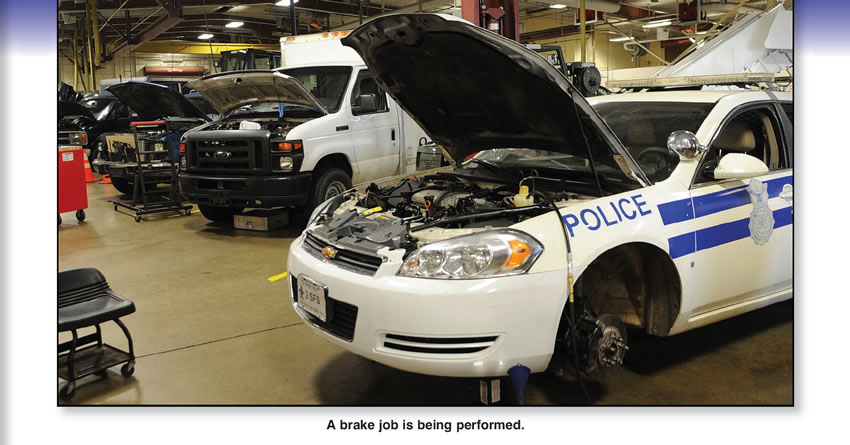

Consideration of offering wholesale repair services is much like visiting a Bresler’s Ice Cream store … there are a lot of flavors from which to choose. Many shops bring a preconceived notion that, for example, with only three bays taking on a fleet maintenance contract would be overwhelming. But not all fleets are the 300-vehicle police force or the reman transmission services involved in serving U-Haul or the U.S. Postal Service. There are any number of ways to dip a toe into the wholesale marketplace that don’t result in the proverbial tail wagging the dog.

In fact, a good first step to looking for wholesale work would be to look to the Yellow Pages or Chamber of Commerce member listing and begin to take a sort of census detailing what businesses and/or government motor pools might fit the shop’s ability to handle from the standpoint of technical ability and volume of work. Included in the analytics would be inferences about the types of services the shop seeks to provide for each.

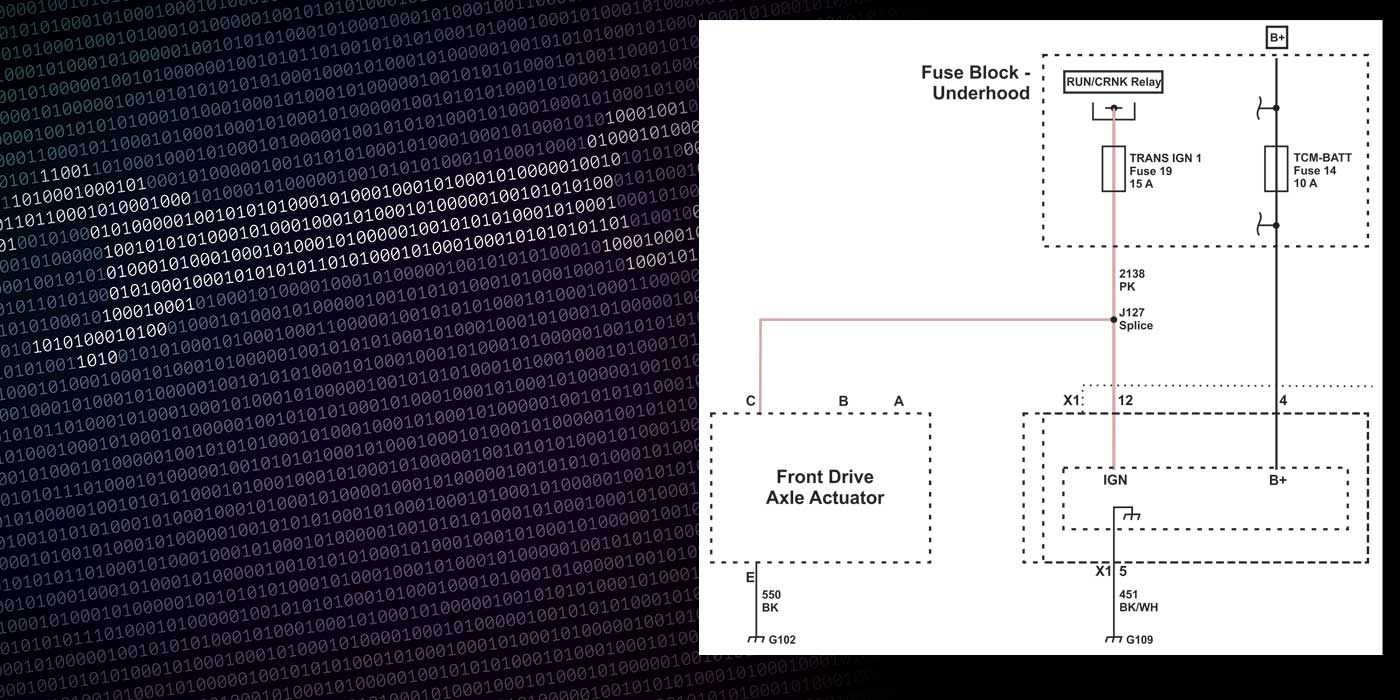

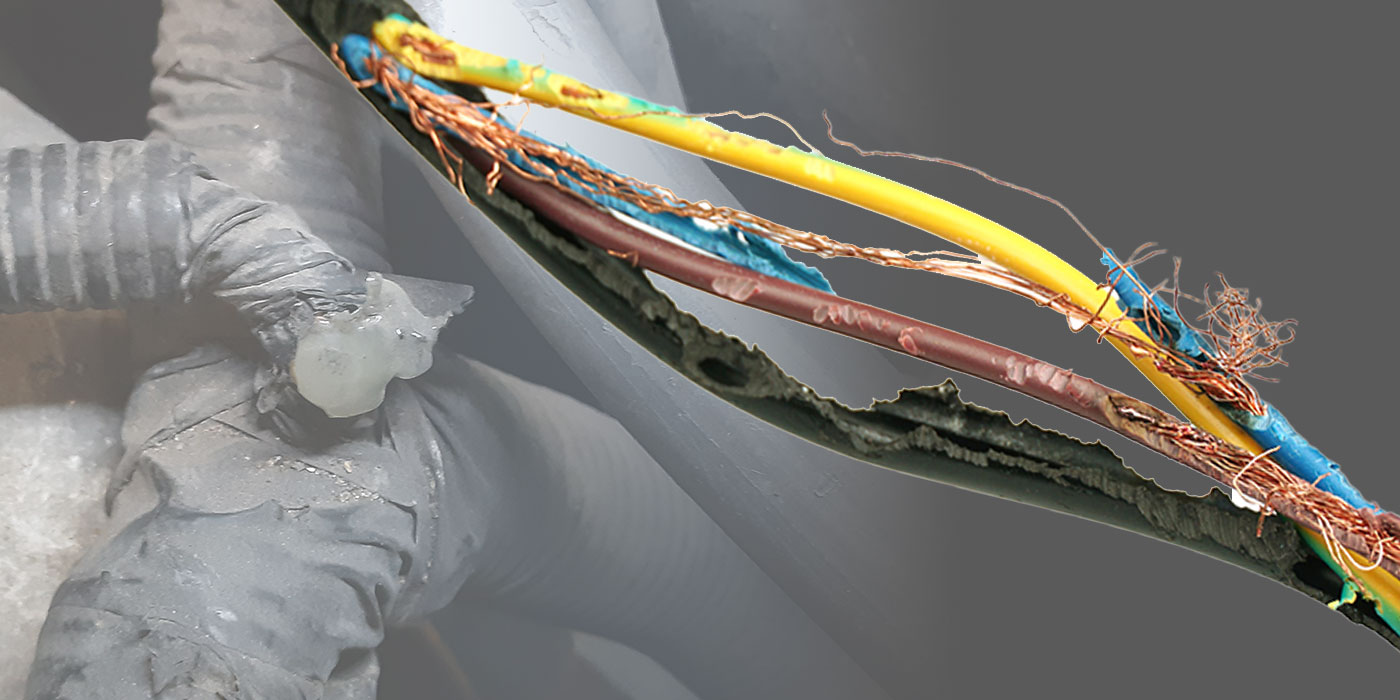

Since the very early days of automatic transmissions, there have been shops that have rebuilt transmissions for other repair facilities on a more-or-less localized basis. These so-called bench builders as a third-party contractor perform complicated repairs like overhauling an automatic transmission. A general repair shop or perhaps a used-car dealership will remove the unit from the vehicle and drop it at the bench builder’s dock. The unit is then rebuilt and returned to the original shop or dealership for reinstallation. A transmission shop can offer its talents in quality rebuilding to other facilities that have regular interaction with a customer base of vehicle owners. Rather than referring work because the client shop hasn’t a rebuilder, it makes a profit on the R&R services while the rebuilding profit goes to the bench building facility.

Such bench-building agreements were very commonplace with shops that performed transmission rebuilding, warranty or otherwise, for new-car dealerships previous to the growth of OEM-sponsored remanufacturing programs that have expanded for the past 20 years or so.

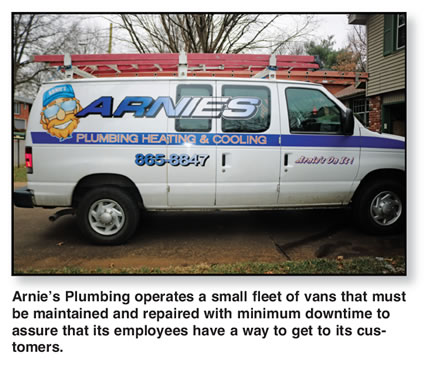

Beyond this traditional role as bench-building contractor, a myriad of possibilities exist. Local plumbers, electricians, ambulances, dairies, etc., often operate fleets from a mere handful of vehicles up to a dozen or two vans, pickup trucks and the like. To a shop, these types of businesses represent something marketers often refer to as “derived demand.” If a local plumbing company has five service vans and one of them has a blown transmission, that firm stands to lose 20% of its revenue; no vehicle, no service call and no service call, no income.

The upside of such business is the plumber is motivated to make sure that truck is repaired and back in service immediately. It’s good for shop business when the first question isn’t, “how much,” but rather, “how soon?” On the other hand, a certain amount of juggling and/or overtime often is necessary to keep that volume customer happy. Having a flexible technician who welcomes being paid to stay late and finish a crucial job becomes an asset in winning and retaining small fleet business.

Steady flow

“G” Truglia, along with being a top technical author and trainer, operates a shop that has experience in satisfying fleet customers. Truglia tells Transmission Digest that in the past several years his fleet business has turned more to training fleet technicians than actually providing service to the vehicles themselves. But, he says, “Fleet work can provide a base that is a relatively steady flow of vehicles.”

The retail business, Truglia says, often fluctuates; one week or month everything is hectically busy and then the car count drops to only a few a week. Business reality finds that when there aren’t any cars in the bays there are still salaries to pay, utility bills to settle and rent that can’t be avoided. The costs continue without the revenue necessary to offset them.

Taking on wholesale work should create a minimum revenue stream without significantly increasing costs to a shop. With a minimum that will cover a large portion, or even all of the shop’s fixed expenses can be the keystone to increasing profits. The role of wholesale work, whether it be transmission or a broader contract that calls for everything from preventive maintenance to major assembly replacement or repair, is to provide such a floor level of activity and the revenues that flow from such activity.

Get the word out

OK, case made! However, just because one sees the desirability of developing wholesale work doesn’t mean that it’s going to happen. Shops of substantial size often have an outside salesperson to handle the face-to-face selling duties. In the transmission aftermarket, few shops are large enough for such luxury.

Truglia said that one of the steps used to develop wholesale accounts was the preparation and printing of a brochure. When preparing such a document it’s important to recall why fleet owners desire to pledge their maintenance and repair needs to a given business. Major selling points are competency of technicians, abilities of the shop, quick turnarounds and lastly price.

In a world of digital reading material, the leave-behind brochure is one of a salesperson’s best tools. To revisit a digital brochure calls for finding the link and browsing the site. A printed brochure reminds people of the possibilities of a wholesale repair/maintenance arrangement for as long as it occupies the desktop. Using both a website AND a brochure is optimal.

Warranty work

In addition to local fleets there are opportunities for local referrals from national repair warranties. These are the plans that vehicle owners can purchase for coverage beyond the life of the OEM warranty.

All of those extended warranties that are sold require a local shop to make covered repairs. Assuredly, these are not jobs likely to be referred to a dealership. This is an area where Truglia’s experience brings a cautionary note. Not all of the extended warranty programs are the same. Some, he says, are much better than others. Developing that business calls for some research as to the payment habits of the warranty program being considered for a shop’s wholesale business portfolio.

On page 4 of this issue is a story detailing the operation of Vehicles Unlimited in Springfield, Mo. Among the many sources of jobs coming to that shop are any Jasper Engines & Transmissions warrantied units that need adjusting, diagnostics or replacing based on Jasper’s warranty program. The owners of the shop become the local face of the nationwide warranty issued by the remanufacturer. When, for sake of example, a transmission that was installed in Toledo experiences problems in Southwest Missouri, Jasper’s hotline will find the nearest authorized service center – Vehicles Unlimited – and the vehicle owner will be directed to that facility. The remanufacturer will pay the shop for work it performs in support of the warranty.

Make the wholesale

There are as many flavors of wholesale agreements as there are wholesale accounts; each is unique. While there’s a pattern and a similarity to the sale of retail jobs coming to a shop bay, the sale of wholesale accounts typically requires an individual proposal and agreement. Preparing such a proposal requires the restatement of how the shop will address the priority concerns of the fleet or wholesale customer. This is the time to make the pitch about the competency of the technicians, the tools and diagnostic abilities of the shop and the fact that work will be completed both quickly and accurately.

If car counts aren’t up to expectation, a fresh look at the opportunities of wholesale work is a perfect way to kick off a new year!